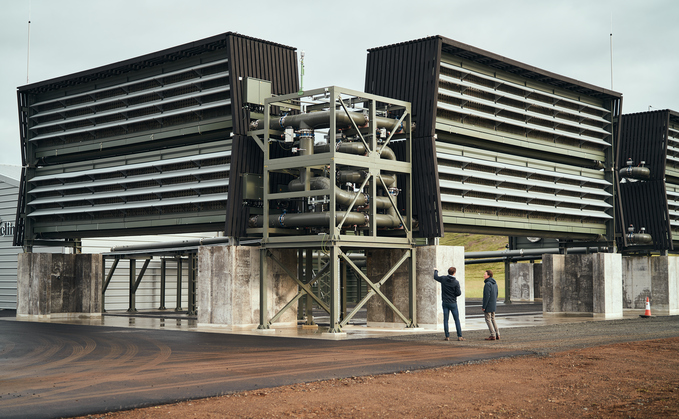

Climeworks launched its direct air capture and storage plant in Iceland in September 2021 | Credit: Climeworks

BeZero Carbon research points to growing commercial interest in carbon removals such as direct air capture, enhanced weathering and biochar

Growing numbers of businesses are now investing in carbon removals such as direct air capture (DAC), enhanced weathering and biochar technologies in a bid to secure future financial savings and position...

To continue reading this article...

Join BusinessGreen

In just a few clicks you can start your free BusinessGreen Lite membership for 12 months, providing you access to:

- Three complimentary articles per month covering the latest real-time news, analysis, and opinion from Europe’s leading source of information on the Green economy and business

- Receive important and breaking news stories via our daily news alert

- Our weekly newsletter with the best of the week’s green business news and analysis