The latest BusinessGreen Webinar, hosted in association with Patch, reveals how there are good reasons to think the voluntary carbon market could be at an inflection point

Voluntary carbon markets have endured a turbulent couple of years. Hit by numerous high-profile allegations of 'greenwashing' over 'junk' carbon credits that should not be trusted to provide promised climate, environmental, and social benefits, all players in the market - including buyers, traders, certifiers, and project developers - have faced intense scrutiny. As a result, some companies have been left more hesitant to participate in the market, with a combination of concerns over reputational damage fears, fatigue around the growing bureaucracy associated with new standards, and pressure to focus on cutting emissions at source serving to dampen demand in some quarters.

But, under such huge pressure to improve confidence in the market, work has steadily been underway to bolster oversight, guidance, and certification frameworks. As a result, there is now a growing sense within the voluntary carbon market (VCM) that supplies of high integrity credits are ramping up and the sector is fast shedding its former 'Wild West' reputation.

More than that, there is increasing evidence that the development of a robust, reliable, and effective market for companies and organisations to funnel investment into carbon removal projects is going to be critical if the world is to meet its climate and nature goals.

Indeed, over a quarter of a century since the Kyoto Protocol established the first major global carbon credits system under the Clean Development Mechanism, a number of industry figures believe 2024 could start to see the VCM cast off the struggles of the recent past and enter a new, more mature phase, attracting much needed investment in the process.

"In 2023 there was a lot of negative press about bad projects," conceded Georgia Berry, UK and European policy lead at leading carbon market platform Patch. "But what I'm seeing now is the whole VCM community coming together really, and recognising they need to do more to shed light on projects that are really effective, and also on what you might call good actors in the industry - those who are buying for the right reasons - and the positive outcomes that are emerging via the voluntary carbon market. I think you'll see a lot more positive stories in 2024 than you've seen in 2023."

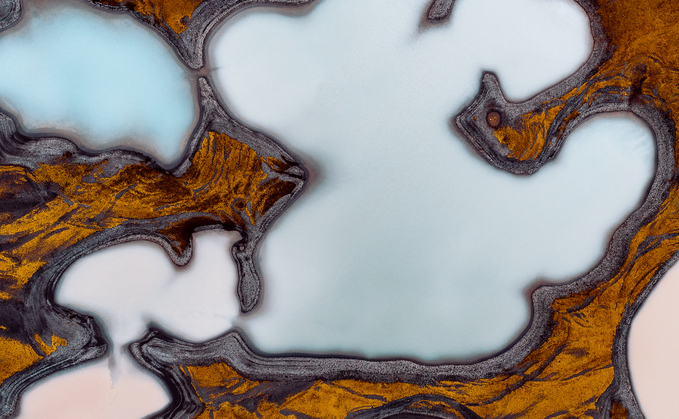

Patch, one of a number of players working to build trust and transparency in the VCM, works with buyers to help procure high integrity carbon credits from a broad range of projects around the world, including both nature-based and technological carbon removal projects. It also works with project developers to help them manage their carbon credit inventory and connect them with buyers.

Berry was speaking as part of a panel of experts during BusinessGreen's most recent webinar - Prizes and Pitfalls: Navigating the voluntary carbon market in 2024 - which was hosted in association with Patch earlier this week. She argued the growing sophistication of carbon market integrity standards was steadily helping to boost trust and transparency in the market.

"Hitherto, there's been rather a plethora of standards, but what we're really seen in the last year is the evolution of standards, both on the supply side - so guiding project developers about what is a high integrity credit and how you can produce one - as well as on the demand side," she explained. "So [the demand side] is really about providing support for those who want to enter the market and purchase credits, but aren't completely clear what is a good quality credit, how to better understand that carbon being pulled out of the atmosphere is going to remain locked out of the atmosphere, and how one can be sure that what you're putting your money into is valuable for your business and for the planet."

Carbon market standards

The green economy certainly has to grapple with its fair share of sometimes opaque and confusing acronyms, and nowhere is this more clearly on show than in the VCM. On the supply side, the Integrity Council for the Voluntary Carbon Market (ICVCM) has developed its own criteria with increasingly stringent 'core carbon principles' that aim to ensure a carbon credit is high integrity in terms of its environmental, climate, and social performance.

And on the buyers' side, meanwhile, there is the Voluntary Carbon Markets Integrity Initiative (VCMI), which is aiming to help walk corporates through the process of purchasing high integrity carbon credits that both support their net zero targets and help scale up carbon removal projects. Patch, meanwhile, is one of a number of organisations and carbon market platforms which feed into standards development via VCMI's stakeholder forum.

Crucially, almost all guidance now makes clear companies should prioritise internal decarbonisation efforts as much as possible, with investments in carbon credits focused on tackling the small proportion of residual, hard to abate emissions in a company's carbon footprint.

Even so, Berry conceded the myriad standards and guidelines, carbon credit-selling platforms, and verification organisations that currently operate across the market have made it "very confusing for buyers". However, she remains confident the coming year should provide far greater alignment between standards, which she said would be key to bringing more corporates to the market.

"Plenty of buyers are just hesitating, I would say," said Berry. "I think you do see buyers who are perhaps more experienced in this space, who know what they're looking for. But really, what I'm hopeful for in 2024 is increased clarity for buyers coming from a number of different directions."

COP28 brought several key announcements on this front, with six major carbon credit registries - including Verra and Gold Standard - agreeing to align their carbon accounting principles. Moreover, independent governance bodies - such as the aforementioned VCMI and ICVCM, as well as the Science Based Targets initiative (SBTi), the Greenhouse Gas Protocol, the We Mean Business coalition of corporates, and climate reporting platform CDP - jointly agreed to provide a cohesive project quality standard covering carbon credit project development through to credit retirement.

Governments could also help pump prime the market by providing more clarity around regulations and their targets for carbon credits and removals, Berry said. "Intermediary regulation is very useful, such as splitting of targets," said Berry. "When you've got your decarbonisation targets, clarifying what needs to come from carbon removal, for example - this will all help."

The hope is these initiatives and trends can help make the market easier for buyers to navigate in the coming year and beyond.

Science Based Targets and clarity on standards

In particular, Berry highlighted the role of the SBTi, which she hopes will provide further clarity on its guidance to companies seeking to secure validation for their net zero emissions targets. At present, the SBTi advises companies should decarbonise 90 to 95 per cent of their direct and value chain emissions by 2050, only leaving scope for harnessing carbon credits to mop up the remaining hard to abate five to 10 per cent.

But Berry argued the SBTi's current guidance on carbon removals and carbon credits is too open to interpretation on what counts as valid action to take with regards to investing in the VCM alongside efforts to decarbonise a company's own operations. "And the SBTi plays a big role in corporate decision making," she added.

Jim Mann, CEO of UNDO Carbon Removal - which specialises in carbon removals through the use of enhanced rock weathering techniques - agreed. Speaking during the webinar, he highlighted the importance of unlocking investment in carbon removals in the near term, to ensure projects and the wider market are given enough time to expand ahead of the point in the 2030s and 2040s when they are likely to be required at scale if mid-century net zero targets are to be met.

As such, there is a need to encourage - rather than discourage - firms from investing in carbon removals today, alongside their investing in internal decarbonisation efforts, Mann argued. His preferred solution is for the SBTi to advise corporates to allocate around 10 per cent of their current climate strategy budget to investing in carbon removals credits today, in line with ensuring these credits and projects can then cancel out that firm's residual five to 10 per cent of emissions when their net zero target date lands.

"The problem is that if everybody decarbonises and then suddenly comes looking for carbon removals credits in 2030, we're not going to have an industry that's sizeable enough to do that," he explained. "We need to be building foundations today to scale up."

As most carbon removals credits and investments remain expensive at present, there is little danger of firms prioritising carbon removals over lower cost emissions reductions at source, Mann pointed out. But even relatively modest investments in carbon removal projects could help catalyse growth across the nascent sector, which would then help drive down the cost of carbon credits.

"In nearly every company on the planet, it's going to be significantly cheaper to reduce emissions than to buy removals, particularly today," he said. "And even at scale, I think that's going to be true - most of the emissions will be cheaper for them to reduce than remove. So that takes away that moral hazard - it's not really there, it's a myth."

Scaling carbon removals investment

The upshot of all of these increasingly stringent guidelines, regulations, and public scrutiny is they should help to drive down the prevalence of the sorts of low integrity credits that have attracted flak in the past.

"What we've got to make sure is that we get an improvement in quality, and not a race to the bottom, which I think we're starting to see," said Mann. "Whereas we were getting a plethora of standards appearing previously, and the danger there is they chip away at each other to be the cheapest route and therefore actually dilute the quality of credits. But what we're seeing now is them come together and start to raise that standard. So that quality bar is going up, which is exactly what we want to see."

With greater availability of high integrity carbon credits, comes growing demand for carbon removal projects, which are increasingly seen as the most reliable form of carbon credits. That is because these projects - whether nature-based, technology-driven, or a combination of the two - actually remove carbon from the atmosphere, as opposed to lower integrity 'avoidance' carbon credits that support projects such as forestry protection, and as such have been the source of concerns over how emissions reductions are calculated.

Engineered, or technology-driven carbon removals in particular also often have the additional benefit of offering more accurately measurable CO2 reductions compared to those based on calculating the amount of carbon held in soils and trees, for example. And it is in this technological carbon removal space that interest has surged in recent years, with major players such as Frontier - the $1bn carbon removals buyers group led by several tech giants such as Shopify, Facebook-owned Meta, Google's parent company Alphabet - aiming to ramp up the nascent sector.

Jeremiah Lim, director for sustainable and impact investment banking at Barclays, believes a confluence of factors - not least the growing backing from climate scientists - is driving significant momentum across the carbon removals space.

"I think 2024 is going to be a big inflection year for engineered carbon removals - we're seeing the tailwinds really pushing forward," he said during the webinar. "We're seeing a degree of scientific consensus now, with the UN IPCC [Intergovernmental Panel on Climate Change] Sixth Assessment Report very clear about the need for carbon removals as part of any pathway for under 2C of global warming.

"And we're starting to see the technologies - in particular, enhanced rock weathering, and bioenergy of carbon capture - reaching a point where they're financially viable. From an economics perspective, you're starting to see projects get to final investment decision where the projects get built, and you're starting to see some large-scale facilities come online, which is really exciting for the industry."

Even so, as Mann noted, carbon removal projects remain in short supply and often require significant investment. The big challenge ahead is getting the market to scale in order to attract more investors into this relatively nascent space and drive down costs over time.

Barclays works with a number of energy clients with advice and financing for carbon removals technologies, as well as working directly with - and sometimes investing in - carbon removals developers. As such, Lim highlighted the importance of long-term offtake contracts for carbon removals to providing certainty for both investors and developers that can then underpin the sector's expansion.

"I think it's absolutely critical that we get the offtake contracts right, because a lot of the financing - not all of it, but a lot of it - is based on the offtake contracts," he said. By ensuring companies are contracted to purchase a certain amount of carbon credits over an agreed timeline, preferably for the lifetime of the contract, "there's long term certainty for both sides", Lim explained.

"In an ideal scenario, you would do it for a longer term at a fixed price, so you have revenue certainty around that," he said.

There are risks, of course, to investing in carbon removals. But companies should look at these projects as investments, rather than the purchase of a physical, definitive product in the form of a carbon credit, advised Lim. "You're investing in the scale up of a technology that is developing rapidly and ultimately getting cheaper, and you should structure your contracts with that lens as well," he said.

The investment outlook for 2024

Many risks are beyond the control of the carbon market, however. The global economy faces a number of headwinds and potential disruptions in 2024, all of which might serve to make investors a little tentative about opening their wallets. The ongoing energy crisis, wars in Ukraine and Gaza, inflationary pressures, and geopolitical tensions are all destabilising factors at the forefront of investors' minds this year. Meanwhile, billions of people are also set to vote in elections in 2024, many of which could lead to potentially major shifts in climate policies and regulations.

But despite this backdrop, Lim believes the market fundamentals for carbon removals and carbon credits remain pretty robust.

"The reality is, if you look at the data from 2023 as a parallel, investments are down in almost all markets, but carbon removals has remained resilient," he said. "It's a function of it being an early market, and people realising the need for it. But also, from an investment perspective, a lot of the companies looking to invest in this area are companies with long-term targets. They realise they have 2030 commitments they are nowhere close to reaching, and investing in carbon removals are, effectively, a hedge for them - they're buying themselves the tools to manage carbon in future."

Indeed, far from being a risky, new market, perhaps carbon removals and carbon credit are in fact the opposite: a safety net investment in the future.

"We've focused a lot on scaling and cost reductions, but really carbon removals is one of the only direct mechanisms that we have as a society to manage carbon dioxide in the air," said Lim. "This is one of the only fundamental tools to manage the risk of global warming - and a lot of companies are starting to see that and invest in that as a long-term hedge."

He added: "There's a lot of capital sloshing about looking for the right kind of investments in climate tech, and I think carbon removal is at the fortunate part of the curve, where people are starting to see it make economic sense."

All of which points to a potentially hugely fruitful year for the world's nascent carbon removals sector, for which the VCM will play a crucial role. Whether greater clarity and alignment of standards can help to boost confidence and crowd in much needed investment in 2024 remains to be seen - but the scientific consensus of the urgent need for carbon removals to meet climate goals is clearer than ever.

As Lim said yesterday, a world without requisite capacity for high integrity carbon removals to help regulate the increasingly CO2-addled climate - and its potential tipping points - in 2030 and beyond is "a scary place to be as a society".

"So we have to balance it," he said. "We have to make sure that we decarbonise first, but we also absolutely need these tools. And there's no way, as the IPCC said, to achieve a 2C world where we mitigate the worst cases of climate change without [carbon removals]."

Hosted in association with Patch, BusinessGreen's webinar - Prizes and Pitfalls: Navigating the Voluntary Carbon Market in 2024 - is available to watch back in full by clicking here.